The Q3 issue of DealMakers AFRICA is out.

Make sure to submit your nominations and deals as we start preparing for the Annual Awards in March 2025....

DealMakers AFRICA Q3 2024 issue

M&A Regional Analysis Q1 - Q3 2024

PE Regional Analysis Q1 - Q3 2024

Largest M&A Deals Q1 - Q3 2024

DealMakers Africa Awards | Nominations

THORTS

Navigating Zimbabwe’s M&A laws

By Tapiwa John Chivanga | Scanlen & Holderness

The potential impact of SPACs on African M&A

By Vivien Chaplin and Phetha Mchunu | Cliffe Dekker Hofmeyer

By Willem Bodenstein and Nicola van Rooyen | Bravura Namibia

Reimagining sustainable development in African mining

By Bruce Dickinson | Webber Wentzel

Evaluating the risk-free rate in Africa’s markets

By Sibongakonke Kheswa| PSG Capital

The importance of ESG in large transactions

By Pitso Kortjaas, Lydia Shadrach-Razzino and Virusha Subban | Baker McKenzie

By Grant Tidbury | Standard Bank

CONTENTS

FROM THE EDITOR'S DESK

The mergers and acquisitions (M&A) environment has shown signs of recovery, particularly in the past three months of this year, but deal flow remains below the level seen in 2023. This is attributed largely to global economic pressures; particularly rising interest rates, which have stymied leveraged buyouts and reduced the availability of debt financing (pg 4).

The value of deal activity for the 2024 year to end-September, as captured by DealMakers AFRICA, was down 10% year-on-year at US$7,25 billion off 282 deals, compared with 2023’s figure of $8 billion (388 deals). Deal activity was highest in West Africa (83 deals) and, more specifically, in Nigeria (48 deals). However, it is Egypt that leads the tables with a total of 52 deals recorded for the period, of which 41 are private equity (PE) transactions.

Oil and gas continue to be pillars for M&A, especially given the strategic importance of natural resources to African economies. However, renewable energy projects are gaining momentum as sustainability becomes a more pressing concern for both local governments and international investors. The growing importance of ESG in large transactions is discussed in an interesting article on page 26. Of the top 10 deals by value recorded by DealMakers AFRICA so far this year, the disposal by Shell of its assets in Nigeria to a consortium tops the table at US$2,4 billion (pg 6).

PE has, in the past, been an influential though not dominant force driving M&A activity. In 2022, PE accounted for 57% of deal flow across the continent, though this has fallen due to the economic environment. But as the high interest rates that initially deterred private equity are expected to gradually ease, increased activity is expected on this front, with the focus on sectors where PE typically plays a strong role, such as consumer goods, healthcare, education and logistics.

According to the latest World Bank forecasts, sub-Saharan GDP is expected to expand by 3.9% next year, though serious risks from armed conflict and climate events like droughts and floods could impact this figure.

M&A activity in Africa in 2025 is expected to be shaped by both recovery and strategic positioning. Global trends reflect a more nuanced and strategic approach to M&A, focusing on long-term resilience and alignment with technological and environmental imperatives. Articles on evaluating the risk-free rate in Africa’s frontier markets (pg 24) and how SPACS offer a compelling alternative (pg 18) speak to this point. As economic and financial conditions evolve, PE’s contribution to M&A could transform, leading to greater deal-making in sectors that capitalise on Africa’s unique growth opportunities.

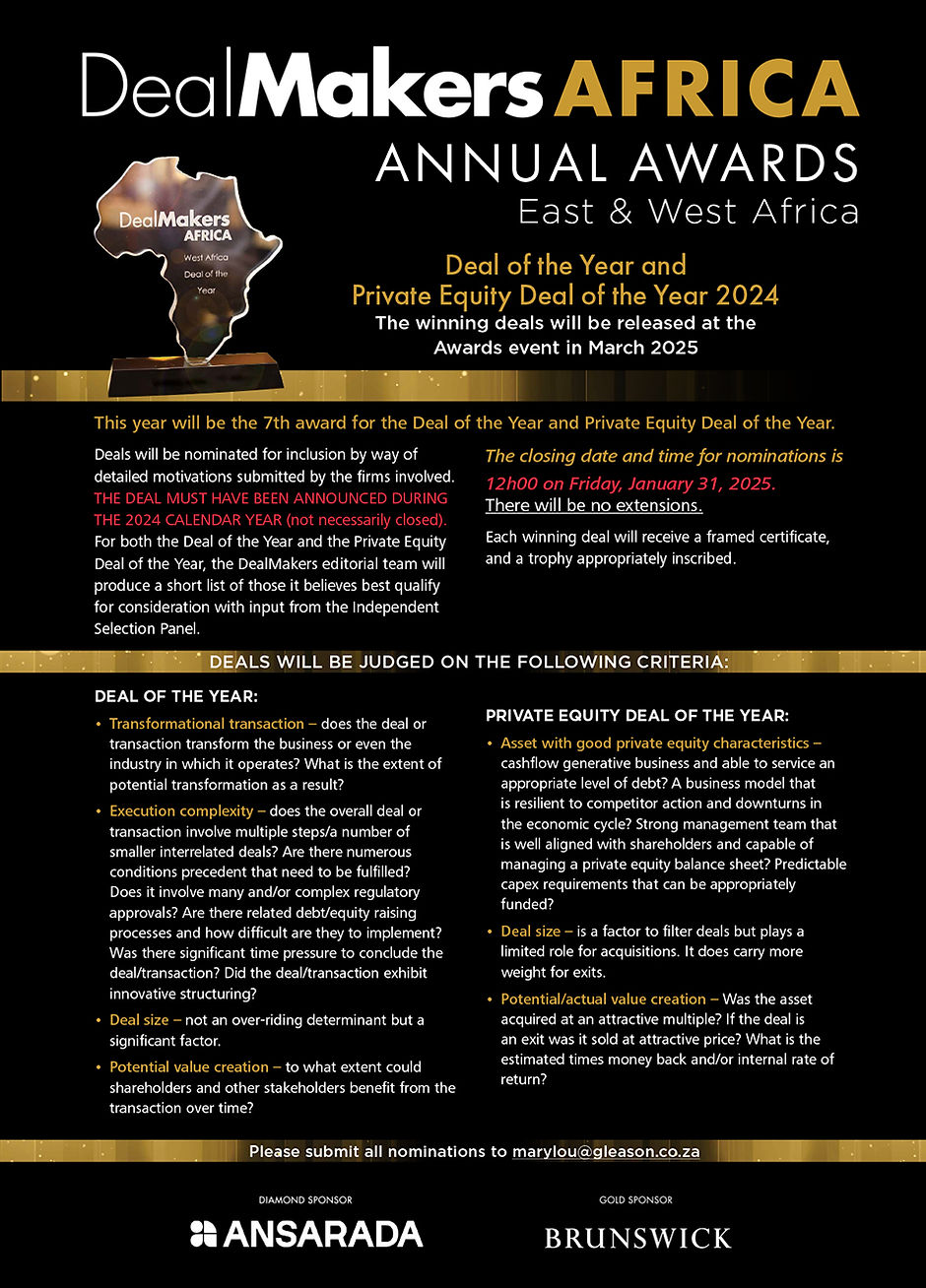

A reminder that DealMakers AFRICA will hold two Awards events in March 2025 – one in Lagos, Nigeria and one in Nairobi, Kenya – to recognise the M&A industry’s achievements in East and West Africa. Nominations for the Deal of the Year, Private Equity Deal of the Year, and the Individual DealMaker of the Year for each region are due by 31 January 2025. Criteria for these nominations can be found on pgs 12 - 13.

Navigating Zimbabwe’s M&A laws: a general guide to regulatory approval

THORTS

Tapiwa John Chivanga

Zimbabwe’s mergers and acquisitions (M&A) landscape continues to grow, driven mainly by its abundant mineral resources — particularly lithium and gold — the capital needs of local businesses, and government efforts to attract foreign direct investment (FDI). Sectors such as mining, energy, agriculture and manufacturing continue to attract the most M&A deal flow, as investors aim to capitalise on Zimbabwe’s untapped natural resources and its strategic location within Southern Africa.

M&A transactions are vital for businesses looking to expand, diversify or enter new markets in Zimbabwe. However, navigating the country’s regulatory landscape can be complex and requires thorough due diligence.

Tapiwa John Chivanga

This article, the first in a three-part series, outlines the key regulatory bodies governing Zimbabwe’s M&A environment, providing essential considerations for businesses and foreign investors.

KEY REGULATORY BODIES IN ZIMBABWE’S M&A LANDSCAPE

Several regulatory authorities are crucial for ensuring compliance in Zimbabwean M&A transactions. The most significant of these include:

Registrar of Companies and Other Business Entities

Role and key functions: The Registrar of Companies and Other Business Entities, established under Section 6 of the Companies and Other Business Entities Act [Chapter 24:31], oversees the registration and deregistration of companies, as well as various administrative tasks, such as company name changes, updates to directors, and changes in share capital and physical addresses. Due diligence on local entities must go through the Registrar’s office, and anyone seeking to verify a company’s existence must consult the Companies Registry.

The Reserve Bank of Zimbabwe (RBZ)

Role and key functions: The RBZ plays a crucial role, particularly in cross-border M&A transactions involving foreign investors and/or financial obligations. Established under the Reserve Bank of Zimbabwe Act [Chapter 22:15] and exercising authority under the Exchange Control Act [Chapter 22:05], the RBZ must approve any acquisition of shares by foreign residents. The RBZ also oversees adjacent processes, such as the repatriation of profits, divestments, and the contracting of foreign financial obligations, which is essential to maintain Zimbabwe’s economic stability by managing foreign currency reserves.

Competition and Tariff Commission (CTC)

Role and key functions: The Competition and Tariff Commission or CTC was established in terms of the Competition Act (Chapter 14:28), and oversees the prevention and control of restrictive practices, the regulation of mergers, the prevention and control of monopoly situations, and the prohibition of unfair trade practices.

M&A transactions involving parties whose combined annual turnover or assets exceed US$1,2 million must be reported to the CTC within 30 days of the merger agreement. This regulatory step ensures market competition is preserved, and that mergers do not result in unfair market dominance. Failure to notify the CTC may lead to steep penalties, including (but not limited to) the complete reversal of the transaction in question. This makes the reporting essential for timely and conclusive transaction closure.

An interpretation of Zimbabwe’s laws generally provides that all mergers that involve the acquisition of a controlling interest in a competitor, supplier or customer, and which breach the above financial threshold, must be notified.

Ministry of Industry and Commerce

Role and key functions: The Ministry of Industry and Commerce, working in conjunction with the Indigenisation and Economic Empowerment Unit, is a critical office to consider when seized with a transaction involving an economic sector reserved for indigenous Zimbabweans.

In terms of the Indigenisation and Economic Empowerment Act (Chapter 14:33), foreign investors are precluded from conducting business in certain economic sectors without an exemption from the aforesaid Ministry and Unit. The reserved sectors include retail and wholesale; transportation: passenger buses, taxis and car-hire services; barber shops; employment agencies; estate agencies; and tobacco processing, grading and packaging, to mention a few.

Zimbabwe Investment and Development Agency (ZIDA)

Role and key functions: Established under the Zimbabwe Investment and Development Agency Act (Chapter 14:37), ZIDA serves as the primary body for the promotion and facilitation of foreign investment in Zimbabwe.

The agency grants investment licenses which provide legal protections, such as the right to repatriate funds; protection from expropriation; and safeguards against discriminatory practices. Additionally, ZIDA is responsible for establishing and regulating special economic zones and appraising, as well as recommending the approval of Public Private Partnerships with the Government of Zimbabwe to the Cabinet.

For M&A professionals and dealmakers alike, ZIDA’s One-Stop Investment Services Centre simplifies the regulatory process by providing a centralised point for approvals, thereby streamlining the transaction process. The One Stop Investment Services Centre is akin to the One Stop Centre of the Rwanda Development Board or, in the case of the Tanzanian Investment Centre, the One Stop Facilitation Centre. This setup significantly enhances the ease of doing business in Zimbabwe, making it more attractive to foreign investors seeking entry through M&A.

Zimbabwe Revenue Authority (ZIMRA)

Role and key functions: The Zimbabwe Revenue Authority is the tax man. In the context of M&A, ZIMRA plays an essential role by ensuring tax compliance, particularly under the Capital Gains Tax Act (Chapter 23:01). Under Zimbabwean law, no transfer of shares shall be valid without a duly issued capital gains clearance certificate; thus, it is essential to apply for same before consummating an M&A transaction.

Once regulatory approvals are secured, M&A transactions can proceed to completion. However, it should be noted that different regulatory bodies may be involved, depending on the exact nature of a transaction. For instance, acquiring a controlling interest in a telecommunications company requires approval from the Postal and Telecommunications Regulatory Authority, while buying a substantial stake (at least 5%) in a financial institution requires approval from the Registrar of Banks.

In conclusion, although navigating the regulatory frameworks of M&A is a complex and often time-consuming endeavour, with proper preparation and an understanding of the regulatory landscape, businesses can successfully execute M&A transactions in Zimbabwe.

Chivanga is a Partner | Scanlen & Holderness

THORTS

Evolving M&A practices in Africa: how SPACS offer a compelling alternative

Vivien Chaplin and Phetha Mchunu

In recent years, the use of Special Purpose Acquisition Companies (SPACs) has gained traction globally as an alternative route for companies to go public, bypassing the traditional IPO process. However, SPACs have yet to gain widespread popularity in Africa’s M&A landscape. Despite this, the potential for SPACs in Africa is significant, driven by the growing need for capital in sectors like fintech, infrastructure, and natural resources, alongside a surge in private equity activity and cross-border deals. This article explores how SPACs are structured in Africa, their advantages and challenges, and recent real-world examples to illustrate their potential impact on the M&A space.

UNDERSTANDING SPACS IN THE AFRICAN CONTEXT

SPACs are publicly listed shell companies created specifically to merge with private companies, offering a faster and more flexible alternative to traditional IPOs. They are typically sponsored by a group of investors or operators, referred to as “sponsors,” who aim to acquire an existing business within a specified timeframe, usually 18 to 24 months. If a suitable target is not found, the SPAC liquidates, and the capital is returned to shareholders.

SPAC LISTINGS ON THE JOHANNESBURG STOCK EXCHANGE (JSE)

In South Africa, the Johannesburg Stock Exchange (JSE) has been proactive in accommodating SPACs as part of its offering, outlining specific requirements for these entities:

Vivien Chaplin

Phetha Mchunu

• No commercial operations at inception: SPACs listed on the JSE cannot have any existing business operations or assets before listing. Their sole mandate is to raise capital and find a suitable acquisition target.

• Capital requirements: For a Main Board listing, the SPAC must raise a minimum of R500 million, while an AltX listing (Alternative Exchange for smaller companies) requires at least R50 million.

• Timeline for acquisitions: The JSE mandates that SPACs must complete an acquisition within 24 months of listing. If no deal is completed within this period, the SPAC is subject to suspension and eventual delisting.

• Investor safeguards: Capital raised by the SPAC must be held in escrow. If an acquisition is not completed within the stipulated time, funds are returned to the investors, ensuring a degree of capital protection.

• Management skin in the game: Directors of the SPAC are required to invest at least 5% of the capital and are restricted from selling their shares for six months post-acquisition. This requirement aligns the management’s interests with those of the investors.

• Lower costs and faster listings: Given that SPACs start without operational assets, they often face fewer disclosure requirements compared to traditional IPOs, reducing listing costs and shortening the time to market.

This framework offers a structured route for SPACs to attract capital while protecting investors, making it an appealing option for both local and international investors interested in the African market.

ADVANTAGES OF SPACS IN AFRICA’S M&A SPACE

• Access to capital: SPACs provide African companies with an opportunity to access international capital without navigating the complexities of traditional IPOs.

• Mitigating IPO market volatility: Given the continent’s market volatility and political risks, SPACs offer a more controlled environment for raising capital.

• Enhanced deal certainty: SPACs are designed with a clear acquisition objective, which provides a degree of certainty to target companies and stakeholders, making them attractive for businesses seeking growth or exit strategies.

EXAMPLES IN AFRICA

• As reported in September 2023, Zeder Investments’ subsidiary, Zeder Financial Services announced the sale of its 92.98% stake in Capespan Group, excluding its pome fruit primary production operations and the Novo fruit packhouse, for R511,39 million. The buyer, 3 Sisters, was a special purpose acquisition vehicle financed by Agrarius Agri Value Chain and managed by 27four Investment Managers. (DealMakers, Who’s Doing What, 21 September 2023)

• In December 2023, 10X Capital Venture Acquisition Corp. II (10X II) (NASDAQ), a publicly traded special purpose acquisition company sponsored by 10X Capital, announced the successful completion of its merger with African Agriculture, Inc. This global food security company, which runs a commercial-scale alfalfa farm in Africa, is now listed for trading on the Nasdaq. African Agriculture is the first pure-play U.S.-listed agricultural company to operate on the African continent. (Latham & Watkins LLP Announcement, 7 December 2023)

• On 1 August 2024, Catalyst Partners (a private equity firm focused on the MENA region) became the first to submit a request to the Egyptian Financial Regulatory Authority to establish a SPAC under the name, Catalyst Partners Middle East. (Grant Thornton, Could SPACs help Egypt’s IPO market take off?, 16 September 2024)

CHALLENGES IN ADOPTING SPACS IN AFRICA

• Regulatory uncertainty: Different African countries have varying regulations governing SPACs, creating a complex legal environment for cross-border transactions. Harmonising SPAC regulations across key markets could unlock more potential for these vehicles.

• Limited market depth: Many African markets lack the deep secondary equity markets required to support SPAC liquidity, making it difficult for investors to exit their positions.

• Political and economic instability: Political instability and economic fluctuations can add additional layers of complexity and risk to SPAC transactions, deterring some investors.

THE ROAD AHEAD: SPACS AS A STRATEGIC TOOL FOR M&A

Despite the current challenges, SPACs hold significant potential in Africa. They could become a key instrument in consolidating industries such as technology, renewable energy, and real estate. As African capital markets mature and more sophisticated regulatory frameworks are developed, SPACs are likely to see increased adoption.

With growing investor interest and local capital markets adapting to accommodate such innovative structures, Africa is poised to become a fertile ground for SPAC-led M&A activity. For dealmakers and investors alike, SPACs present a compelling opportunity to tap into the continent’s untapped potential.

Chaplin is a Director and Mchunu an Associate in Corporate & Commercial | Cliffe Dekker Hofmeyer

THORTS

Unlocking Namibia’s potential: Trust Administration in a thriving economy

Willem Bodenstein and Nicola van Rooyen

Trust administration and management are global practices essential for wealth planning and asset protection. While Namibia may be lesser-known, compared to established jurisdictions like Jersey and Guernsey, it is quickly emerging as a key player in this space, offering a robust regulatory environment. These well-known offshore financial centres are renowned for their strong legal frameworks, offering flexibility, privacy, and asset protection. Investors often choose these jurisdictions for their stable, transparent systems and global recognition, making them prime choices for high-net-worth individuals seeking comprehensive wealth protection.

Namibia, though different in scale, shares many of these benefits. Bravura recognised early the growing demand for trust administration services. Initially established to manage internal structures, Bravura Administration Services (BAS) quickly identified a need in the market to assist clients with personal trust administration, especially following new regulations. These regulatory updates introduced hefty penalties for non-compliance, making it essential for clients to have a reputable partner to ensure that trusts remained compliant. Bravura, with its long-standing relationships and vast network, stepped in to help clients navigate these complexities and achieve the same high standards of administration, meeting international criteria.

The Namibian economy further supports this burgeoning demand for wealth management. According to the African Development Bank, Namibia’s projected GDP growth is 3.8% in 2024 and 4.2% in 2025. This steady growth, driven by Namibia’s ties to the Southern African Development Community (SADC) and its expanding energy sector, creates fertile ground for long-term wealth management strategies, including trusts. Establishing a trust in Namibia allows individuals to safeguard their assets, minimise tax exposure, and ensure a seamless transfer of wealth across generations.

Willem Bodenstein

Nicola van Rooyen

Bravura’s Namibian office is a team of nine, led by Willem Bodenstein. Today, BAS administers more than 100 trusts and companies, managing a growing portfolio of client assets. The company has fostered strategic partnerships with leading law and audit firms in Namibia, combined with the knowledge, networks and resources that Bravura’s South African office can tap into. This allows BAS to remain up-to-date with all relevant laws and regulations, while providing access to top talent and skills. This symbiosis results in access to leading industry experts, and ensures that clients receive world-class service and the confidence that their trusts are compliant with the latest regulations.

We are able to leverage cutting-edge technology and real-time dashboards to ensure compliance and efficiency, and it’s been rewarding to see the systems we’ve invested in deliver such positive results for both BAS and our clients. Our Corporate and Trust division recently underwent a Financial Intelligence Centre (FIC) audit, and the outcome was extremely positive.

As BAS continues to grow and serve its clients, its ability to collaborate with top investment managers, while maintaining independent oversight, ensures that trusts and corporate structures are managed to the highest standards. For investors seeking both stability and opportunity, a trusted fiduciary service provider is essential to navigate the local and global requirements for safeguarding assets and preserving wealth for future generations.

Bodenstein is Head and Van Rooyen is Corporate and Trust Manager | Bravura Namibia

THORTS

Reimagining sustainable development in African mining: the Catalyst Approach

Bruce Dickinson

In the complex landscape of African mining, particularly in South Africa, the concept of sustainable development has long been a point of contention. Mining companies, faced with increasing pressure to contribute to long-term community development, often view these initiatives as an additional tax – a perspective that can hinder both mining operations and genuine sustainable growth.

A paradigm shift is needed: from viewing mining companies as direct providers of development to seeing them as catalysts for sustainable economic ecosystems.

Bruce Dickinson

THE CURRENT PARADIGM: Unsustainable and unappreciated

The traditional approach to sustainable development in mining regions has been characterised by the direct provision of services and infrastructure by mining companies. This model, while well-intentioned, presents several critical issues, such as:

• Increased operational costs: Mining companies often see sustainable development initiatives as an additional financial burden, potentially driving away investment and increasing cut-off grades, thereby sterilising minerals that could otherwise be economically extracted.

• Misaligned responsibilities: Local municipalities, facing their challenges, increasingly push their responsibilities onto mines. This blurs the lines between corporate social responsibility and governmental duty.

• Lack of recognition: Despite significant investments in schools, clinics and other infrastructure, mining companies receive little recognition. Host communities often view these provisions as rights, rather than corporate contributions.

• Post-closure unsustainability: Services and infrastructure provided directly by mines often become unsustainable after mine closure, leaving communities vulnerable.

• Siloed approaches: Different departments often pursue separate sustainability initiatives within mining companies, missing opportunities for synergy and efficiency.

THE CATALYST MODEL: A new approach to sustainable development

To address these challenges, we propose a shift towards a “catalyst model” of sustainable development. In this approach, mining companies focus on creating conditions that catalyse broader economic development and attract diverse investments. Key elements of this model include:

• Strategic infrastructure development: Instead of building infrastructure solely for mining operations, companies should design and develop infrastructure that can serve as a foundation for diverse economic activities post-mining.

• Land use planning for the future: Mining companies should engage in long-term land use planning, considering how mining lands can be repurposed for agriculture, tourism or other industries after mine closure.

• Skills development for diversification: Training programmes should focus not just on mining-related skills, but on transferable skills that can support a diversified local economy.

• Incubation of local businesses: Mining companies can act as incubators for local businesses that can serve the mine but are not wholly dependent on it, fostering a more resilient local economy.

• Collaborative governance models: Developing structures for collaborative decision-making between mining companies, local governments and communities can ensure more sustainable and widely accepted development initiatives.

Benefits and key considerations of a catalyst approach

Embracing this catalyst model offers several benefits, such as reducing the perceived extra operational costs, which can make mining investments more appealing. Concentrating on initiatives with multiplier effects ensures more efficient resource utilisation, which fosters the development of a diversified local economy that can prosper beyond the mine’s lifespan. By acting as catalysts, rather than service providers, mining companies can contribute to clearer stakeholder roles and responsibilities, potentially enhancing overall governance and service delivery. A successful catalyst approach can substantially improve community relations and strengthen the social license to operate.

Transitioning to a new catalyst model will necessitate significant adjustments from all parties involved. Governments must establish policies that encourage and reward this model, possibly through tax incentives or licensing regulations. Mining companies should adopt a more cohesive approach, breaking down departmental barriers to fully leverage the catalytic potential of their operations. Transparent communication with communities and other stakeholders is essential to manage expectations and emphasise the long-term advantages of this strategy.

New metrics will be required to gauge the effectiveness of sustainable development initiatives, focusing on long-term economic resilience, rather than short-term service provision. Furthermore, mining companies should collaborate on regional development initiatives, combining resources and expertise for a more substantial impact.

A call for transformative action

The catalyst model represents a transformative approach to sustainable development in mining regions. By shifting from direct provision to strategic enablement, mining companies can contribute to truly sustainable development while potentially reducing costs and increasing investment attractiveness.

Adopting this approach demands a long-term vision, creative problem-solving, and a collective effort from all parties involved. While challenging, the benefits of this transformation – thriving local economies, strengthened community ties, and a more environmentally conscious mining sector – make it an essential and worthwhile pursuit.

As we navigate the complex challenges of sustainable development in African mining, the catalyst model offers a promising path forward. It’s time for mining companies, governments, communities and investors to embrace this new paradigm and work together towards a more sustainable and prosperous future for mining regions across the continent.

Dickinson is a Partner | Webber Wentzel

THORTS

Evaluating the risk-free rate in Africa’s frontier markets

Sibongakonke Kheswa

Sibongakonke Kheswa

The International Monetary Fund (IMF) projects that between 2024 and 2028, the gross domestic product (GDP) of African frontier markets will grow at an average rate of 4.2% per annum. Notably, countries such as Mozambique, Rwanda and Senegal are poised for substantial growth, with projected annual increases of 7.8%, 7.2% and 6.8% respectively.1 Whilst Africa is well poised for growth, investors looking to invest in these markets are often confronted by challenges, especially when considering valuations and investment decisions. A central component in valuations and investment decisions is the risk-free rate (RFR) – typically represented by government bonds – which implies a return on investments devoid of financial loss. In current financial climates, the importance of the RFR has intensified due to increased economic volatility and geopolitical uncertainty, including significant fluctuations in inflation and interest rates.

This heightened relevance of the RFR stems from its role in helping investors gauge the baseline returns on their investments against a backdrop of unpredictable market conditions. By understanding the RFR, investors can better assess the additional risks and potential returns associated with various investment opportunities.

Accordingly, it is crucial to identify the specific challenges faced in determining the RFR in African frontier markets, particularly those with less developed financial infrastructures. These markets often grapple with issues such as limited bond market liquidity and inconsistent economic data, which can complicate the accurate assessment of the RFR. By understanding these unique challenges, investors can better evaluate and account for the inherent risks when making investment decisions in these regions.

CHALLENGES WITH THE RFR IN AFRICA

Reliability of government bonds: Globally, government bond yields are often used as a proxy for RFR as, in principle, governments do not default on their debt because they can print more money to pay the bond, if required to. However, in frontier markets, government bonds may be an unreliable proxy for a “risk-free” rate, due to economic instability, political unrest and market illiquidity. The low liquidity in these bond markets can lead to broad yield spreads that do not accurately reflect market conditions, and make them difficult to price. Added to this is the limited availability of data on these bonds.

Currency volatility: High currency volatility adds another layer of complexity in some African markets, especially for foreign investors. Fluctuating exchange rates can significantly impact the real value of returns due to the added forex risk, which, again, makes it difficult to price accurately.

THE IMPACT OF SUCH CHALLENGES WHEN DETERMINING THE WEIGHTED AVERAGE COST OF CAPITAL (WACC)

The RFR is a key building block when calculating the WACC and, ultimately, value. It encapsulates the required rate of return from all sources of capital and is intended to reflect the aggregate risk that the valuation subject is exposed to, including country risk.

The RFR anchors the calculation of the cost of equity through the Capital Asset Pricing Model (CAPM), which is integral to the WACC. The RFR serves as the baseline return required for an equity investment, before making adjustments for correlated and uncorrelated risks associated with the valuation subject in question, to adequately compensate investors for the risk assumed.

Similarly, the cost of debt, which forms the other part of the WACC, is also intrinsically linked to the RFR. The cost of debt can be described as the credit spread, which indicates the extra yield needed above the RFR, taking into account the lender’s creditworthiness and the economic environment in which the lender operates. This is typically the rate at which a bank is willing to lend to a business after taking into account the risks associated with that business.

Given the typically higher RFR in Africa, the resultant WACC is also higher, indicating a perception of greater investment risk and the higher return required to compensate for this risk, which drives valuations down. This scenario poses a significant challenge to capital inflow, as investors require higher returns to justify the increased risk associated with investing in Africa and, in some instances, are not willing to assume such elevated risks (perceived or otherwise) to achieve higher returns.

POTENTIAL SOLUTIONS WORTH CONSIDERING

Leveraging local sovereign bonds: While U.S. Treasury Bonds are often used as a base for calculating the RFR due to their stability and liquidity, they do not fully capture the inherent risks present in African frontier markets. While adjustments can be made to recalibrate U.S. Treasury yields for country and currency-specific risks, this method can oversimplify the complexities of the African market.

A more suitable approach may be to use local sovereign bonds, if available and sufficiently liquid, to provide a closer approximation of the risks specific to the region. Often, this also more accurately reflects the risk of one country relative to another, where the one may have more reliable data available on it.

Composite indices for illiquid bonds: In cases where local bonds are illiquid, a composite index that factors in country risk premiums, inflation volatility and currency risk could offer a more accurate reflection of a RFR in these markets.

Strengthening local financial markets: In the long term, developing more robust financial systems in Africa is crucial for driving liquidity and providing reliable data for benchmarking and risk assessments. This should assist in attracting investment and laying the groundwork for improved capital markets and sustained economic growth.

To accurately value companies within the current constraints of African financial markets, it is crucial to leverage existing resources effectively. A more suitable approach may be to use local sovereign bonds, if available and sufficiently liquid, to provide a closer approximation of the risks specific to the region. If these bonds are illiquid, a composite index that factors in country risk premiums, inflation volatility and currency risk — calibrated against more stable regional/local markets – could offer a more accurate reflection of risk-free capital in these environments.

In the meantime, it is essential to recognise and adapt to the limitations of the current financial infrastructure. By refining how we use these existing tools (local sovereign bonds and region-specific indices), we can better understand and navigate the complexities of African markets. This strategy not only supports more accurate company valuations, but also contributes to enhancing financial stability and fostering investor confidence, which is vital for ongoing economic development across the continent.

Kheswa is a Corporate Financier PSG Capital

1. International Monetary Fund, 2024. World Economic Outlook, April 2024: Steady but Slow: Resilience amid Divergence. [online]

Available at: https://www.imf.org/en/Publications/WEO

THORTS

The growing importance of ESG in large transactions

-(003).jpg)

Pitso Kortjaas

Global institutional capital is increasingly focused on sustainability, both as an investment opportunity and as part of investment criteria. This is driven by the forecasted (positive and negative) economic impact of the climate change mega-trend, regulation such as the EU’s Carbon Border Adjustment Mechanism, and societal pressure to address unsustainable corporate practices.

Africa presents fertile ground for scalable, high impact Environmental, Social and Governance (ESG) projects and programs. The continent boasts some of the world’s richest renewable energy generation potential, and many of the resources needed to build green technologies. African countries’ unique developmental journeys also present a wide range of opportunities for corporate supported social interventions to have a real impact.

Sub-Saharan Africa has great potential for investments with material sustainability outcomes, and this is already being realised through higher transaction volumes and values in industries that are enablers of sustainability initiatives, such as renewable energy, copper, and other green tech minerals.

Sustainable, alternative investments are another key opportunity, with major African bourses listing green and sustainability linked bonds for several years, and the Johannesburg Stock Exchange’s (JSE) Socially Responsible Investment (SRI) index’s continuous innovation. Social impact investments by corporates are also on the rise, with the recognition that when properly designed and implemented, these projects and programs can have an exponential impact on an organisation’s sustainability credentials and, most importantly, the lived reality of the participants.

The sub-Saharan Africa region is witnessing a surge in ESG-focused investments, catalysed by an increasing awareness of, and appetite to pursue, the opportunities presented by sustainable investment in Africa. The importance of leveraging ESG for economic development has been recognised, not only in market led initiatives such as green finance and sustainable investment strategies, but also in state-led, multilateral initiatives like the African Union’s Agenda 2063. The market is seeing an increasing trend towards factors within the sustainability / ESG stable becoming central in large transactions. Capital is being directed towards value chains set to benefit from sustainability driven changes, like the electric vehicle value chain. Companies are driven to integrate ESG practices, not only to ensure continued social and regulatory license to trade, but as a strategic imperative to attract investment. Africa is well-positioned to attract large investments into its strategic sectors, and presents an opportunity for multinationals and other corporates to make investments that will have an exponential impact on their sustainability scorecard.

.jpg)

Lydia Shadrach-Razzino

Virusha Subban

Pitso Kortjaas, Lydia Shadrach-Razzino and Virusha Subban

Climate change and increased scrutiny of corporates’ sustainability practices by the public and regulators has driven ESG high up the agenda of many institutional investors and major corporates, leading to an increase in sustainability-focused investments – either purely for the green credentials, or for the potential for returns from a value chain that will benefit from increased take-up of sustainability actions. The deployment of capex and opex budgets by corporates is also increasingly being influenced by factors such as the social and environmental impact of the spend. ESG factors are thus becoming important considerations in transactions, especially in sectors which are set to grow due to sustainability initiatives, or those that are either socially or environmentally sensitive.

ESG’s role as a major market force is undoubtable, with ESG-focused investments having surged and assets held surpassing US$30 trillion in 2022. The importance of ESG is emphasised by the significant rise in green and sustainability-linked financial service offerings, and ESG-focused spending by Corporates.

ESG’S MOMENTUM IN AFRICA

While sustainable investment is a global trend, Africa is seeing the manifestation of this shift through targeted initiatives and strategic investments that address both regional development and global sustainability goals. Indications of momentum include:

Strategic development initiatives: The African Union’s Agenda 2063 integrates ESG as a key factor for continental development, prompting initiatives such as Gabon’s “Green Gabon” for renewable resource regulation, Benin’s launch of green bonds, and Côte d’Ivoire’s mandatory CSR reporting since 2014.

Corporate strategy: a 2023 Oxford Business Group study revealed that 19.7% of African CEOs pursued ESG standards to enhance their reputation, alongside motivations like regulatory compliance and stakeholder demands. Companies adopt ESG principles to ensure their license to trade and attract capital, which is increasingly targeted at sustainable investments.

South African initiatives: South Africa is a leading African jurisdiction for sustainable investments with national measures. The Johannesburg Stock Exchange (JSE) was the first global stock exchange to introduce a SRI index and it has listed over 70 sustainability-linked bonds, raising approximately R11 billion in 2023. A 2024 review showed significant ESG adoption among JSE-listed companies, highlighting South Africa’s proactive role in promoting sustainable finance and ESG integration across the region. ESG has also been a priority from a regulatory perspective, with the introduction of amendments to the Pensions Fund Act and Public Investment Corporation Act regulations to drive sustainability requirements.

ESG AND SUSTAINABILITY ARE KEY THEMES IN RECENT LARGE AFRICAN TRANSACTIONS

ESG has been a key consideration in recent major transactions in Africa, including:

- Proparco Group’s September 2024 investment of $15 million into Pembani Remgro Infrastructure Fund II (PRIF II), a leader in infrastructure investments in Africa with strong ESG credentials;

- Vitol Africa’s recent acquisition of Engen for R37 billion, a significant investment into South Africa, with strong ESG underpinnings due to its impact on disadvantaged communities; and

- a R9,3 billion loan provided by several lenders, including the Development Bank of Southern Africa Limited; Old Mutual Alternative Investments; Sanlam; and Stanlib Alternative Investments to fund Oya Energy, a hybrid energy project combining solar, wind, and lithium-ion batteries, expected to be the largest initiative of its kind in Africa.

Major corporate and investment banks with strong ESG focuses have also made a significant impact in the region. One South African bank has issued approximately R45 billion in sustainable financing and mobilised approximately R15,5 billion in green project finance and an additional R1,2 billion in social project finance to fund renewable energy, carbon projects, and basic infrastructure in Africa; and another has embraced numerous climate-related initiatives, such as their Green Private Power Tier 2 Bond, launched in 2023 with a notional value of R2,1 billion.

In addition, there are major renewable energy infrastructure projects being financed and coming online in Africa. For example, the Hive Hydrogen Project in Gqeberha – a $4,6 billion project that involves the construction of a green ammonia plant in the Coega Special Economic Zone – which aims to produce 780,000 tons of green ammonia annually, powered by renewable energy sources.

OVERCOMING THE CHALLENGES OF SUSTAINABLE INVESTING IN AFRICA

To successfully tap into the sustainable investment opportunities presented by sub-Saharan Africa, global corporates and capital must overcome the unique challenges of deploying capital and operating in the various jurisdictions on the continent, which requires an intimate and practical knowledge of the diverse regulatory frameworks in operation. In cases such as this, companies looking to invest will be best served by an adviser that understands their needs and priorities, as well as the intricacies of the African investment landscape.

Kortjaas, Shadrach-Razzino and Subban are Partners in Banking & Finance, M&A and Tax |

Baker McKenzie (Johannesburg)

Navigating M&A in Africa: challenges, opportunities, and the path forward

THORTS

Grant Tidbury

As Africa’s largest bank by assets, Standard Bank Group stands at the forefront of the evolving M&A landscape in Africa. Its unique position in this dynamic environment, where strategic corporate actions hold the potential to unlock significant growth, is a testament to its expertise, capabilities and credibility.

Despite the hurdles of economic stagnation, poor infrastructure and high unemployment, the resilience of South Africa’s business landscape is undeniable. As case in point, take the recent formation of our Government of National Unity (GNU), which has bolstered optimism across sectors, creating fertile ground for increased corporate activity in the latter half of this year and, I believe, beyond.

Grant Tidbury

At Standard Bank, we are forecasting a busier and even more dynamic 2025 as corporates regain confidence and position themselves for growth. Conversations with our clients reveal a clear trend: businesses are ready to engage in mergers, acquisitions and restructuring as they seek to capitalise on new opportunities in an improving environment.

Opportunities Amid a Changing Economic Landscape

One key driver of this renewed activity is the recent improvement in South Africa’s power supply. Eskom has provided uninterrupted power since March, boosting business confidence and increasing activity across industries. This is reflected in the S&P Global South Africa Purchasing Managers’ Index, which rose to 51 in September – the highest reading since February – indicating expansion in manufacturing and business sectors.

While challenges such as crime, corruption and unemployment persist, the private sector is increasingly seen as a driving force, building the nation’s future. There is a palpable sense of hope that, with the right partnerships, the private sector can be instrumental in overcoming these issues. This optimism is echoed by South African corporates, who are positioning themselves for M&A opportunities in this improving landscape.

The Johannesburg Stock Exchange (JSE) is also responding to the market’s needs. With a substantial decrease in the number of listed companies since the late 1990s, the JSE is now taking steps to attract more listings. These reforms, aimed at reducing listing costs and easing compliance requirements, are expected to facilitate easier access to capital for corporates, particularly smaller companies. While the reforms will take time to bear fruit, they are a positive step toward increasing market liquidity and encouraging more companies to explore listing as part of their growth strategy.

Standard Bank’s M&A Expertise

At Standard Bank, we take pride in our ability to navigate complex M&A transactions across Africa. With over 40 full-time M&A professionals across key sub-Saharan African regions, including South Africa, East Africa and West Africa, we have the expertise and local knowledge to structure and execute successful deals in even the most challenging environments.

In 2023 alone, we completed several high-profile M&A transactions worth over US$8,43 billion, making us the top M&A adviser in the region by market share. Our team has consistently delivered value for clients by managing risk, ensuring regulatory compliance, and structuring innovative deals that maximise synergies.

We were proud to act as joint financial advisers in the acquisition of Engen, one of South Africa’s largest gas-station chains, by Vivo Energy. This transaction exemplifies our ability to create pan-African champions in strategic sectors, such as energy. The deal’s success hinged on careful negotiation with stakeholders, including South Africa’s anti-trust regulator, and a comprehensive public-interest framework to ensure smooth completion.

Our advisory services are not limited to big-ticket transactions. We are also trusted advisers in smaller, yet equally strategic, cross-border deals. For example, our team advised China’s Huaxin Cement on its US$231,6 million acquisition of Natal Portland Cement, a transaction that expanded the firm’s presence in Southern Africa. This deal showcased our ability to structure cross-border transactions while navigating complex regulatory environments.

We have also been active on the rest of the continent, advising on landmark cross-border deals. Our East African team recently acted as sole financial adviser to Lipton Teas & Infusions, the world’s largest teas and infusions company, on the sale of its tea estates in Kenya, Tanzania and Rwanda to Sri Lanka-based Browns Investments Plc. This deal was complex, yet transformational for the tea sector in East Africa, and resulted in the creation of a community welfare trust dedicated to addressing the needs of the local and neighbouring communities.

In Nigeria, we recently acted as sole financial adviser to Singapore-headquartered Tolaram’s acquisition of Diageo Plc’s majority stake in Guinness Nigeria Plc, which was established in 1950 and has grown to become a leading player in the beer and non-alcoholic drinks industry in Nigeria. Standard Bank also provided acquisition funding for the transaction.

Tailored Solutions for African M&A

One of the critical aspects of executing successful M&A in Africa is the ability to tailor solutions that address the unique challenges and opportunities of the continent. At Standard Bank, we offer a full suite of advisory services, including mergers and acquisitions, strategic disposals, corporate restructuring, and Black Economic Empowerment (BEE) advisory. Our established pan-African presence, coupled with strategic partnerships and presence in key financial hubs such as China, the UK, US and Dubai, allows us to structure deals across geographies, helping clients achieve their ambitions.

Whether by developing bespoke financing solutions or leveraging our deep local expertise, our approach is always innovative and strategic, ensuring that our clients are well-positioned to capitalise on growth opportunities while mitigating risks.

As South Africa and the broader African continent move towards greater economic stability, the opportunities for M&A will only continue to grow. Standard Bank is uniquely positioned to help corporates navigate this evolving landscape, offering world-class advisory services that help businesses grow, innovate and thrive. Whether you are looking to merge, acquire or restructure, Standard Bank is your trusted partner in realising your strategic ambitions.

Tidbury is Head of M&A Advisory | Standard Bank